QuickBooks Services

QuickBooks Accounting & Bookkeeping Services

QuickBooks Set Up

QuickBooks Clean Up

QuickBooks Maintenance

QuickBooks Instruction, Training, & Consulting (private or groups)

QuickBooks for Small Business

Automatic Payments Using QuickBooks

QuickBooks Online Access

What Types of Businesses Benefit From QuickBooks Online?

Small businesses with moderate volume are great candidates for QBO. Contact us to discuss your accounting needs and we can help you determine if QuickBooks Online is right for you.

QuickBooks Tips

Tip 1 - Adding a Customer to QuickBooks On-line

Tip 2 - Importing Customer Lists in QuickBooks On-line

Tip 3 - Creating Invoices

Tip 4 - Adding a Vendor

Tip 5 - Entering A Bill

Tip 6 - Pay a Bill by Check

Tip 7 - Running a Profit & Loss Report

Welcome back to our QuickBooks Tip of the Week Series. Today, we will look at how to run a profit & loss report in QuickBooks Online (QBO). Within minutes, you can see exactly how your small business has been doing over a specific period of time. Like many of the other reports we are going to cover in the series, it is best to run these reports regularly to get a complete understanding of your financial landscape.

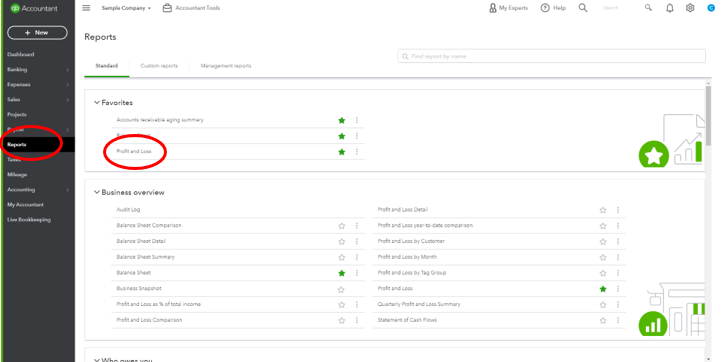

To begin, click on the “Reports” tab on the left toolbar (circled in red below). You will see various reports you can run, but “Profit and Loss” will be under “Favorites” in the center of the screen (circled in red below).

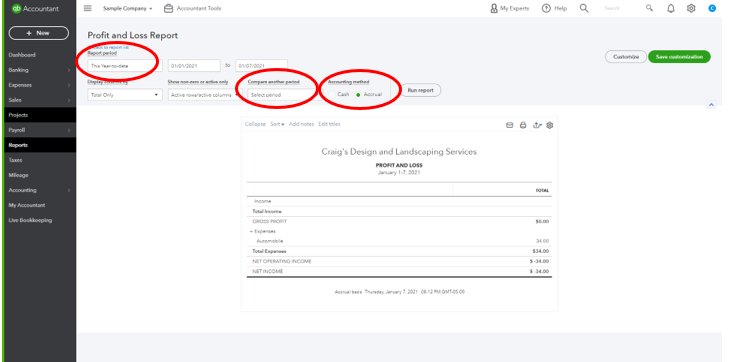

After clicking on “Profit and Loss,” a new screen will load with a standard “This Year to date” profit and loss report already loaded. By changing the “Report period” (circled in red, top-left) you can easily adjust the period of time being included, such as past month, quarter and year. You can also click the drop-down menu for “Compare another period” (circled in red, center) to pull up profit and loss numbers from two different times and see how financials have changed.

One thing to note is make sure your accounting method is set correctly. QBO sets it to Accrual as standard, but many small businesses use the cash method. (circled in red, center-right)

After running the report, you can email or print the document in addition to saving it as an Excel file or PDF. Being able to quickly create profit and loss reports help you stay aware of the direction your small business has been heading. You can even create P&L reports for future dates and see where your current financials are headed.

Want more tips on using QBO for your small business? Subscribe to our mailing list or follow us on Facebook, Instagram and Twitter!