A Sensible Accounting Checklist for Small Businesses - Part 2

Monthly Accounting Tasks

Monthly tasks fall into two categories. The first category is your “normal” end of month tasks such as balancing your checking accounts, approving payroll and other monthly tax payments, and review month end inventory. These may be the ones that almost all business owners are already doing. The second category are those that may done in a more haphazard way or not at all but are extremely important to complete monthly. First, make sure your data is backed up monthly. You might already be using a cloud-based accounting system that handles this. Secondly, review your actual profit/loss report compared to last quarters or even the same month the previous year. This may show you a clear trend for the current year as well as how well you are doing compared to the previous one.

Quarterly Accounting Tasks

Almost all of your quarterly tasks revolve around tax payments, as most states require quarterly submissions for income and sales taxes. (These can be more often, so check your state requirements!) You will also need to submit your quarterly payroll reports now as well.

One thing that is helpful to do a quarterly review of your profit and loss report. Make sure you know how much you are making and where your spending is going. With this information, you can make needed adjustments to boost profit margins.

Yearly Accounting Tasks

The year end brings the final three items on your business checklist. First if you have products, it will be time to review your entire inventory. Second, compile your full year financial reports such as profit and loss statement, cash flow statement and balance sheet. Once these are completed, have them checked for accuracy so you can then file your taxes. Finally, don’t forget to complete your IRS Forms W-2 for each employee and your 1099-MISC for any contract workers. That’s it!

Staying On Top Of Accounting Tasks Is Critical

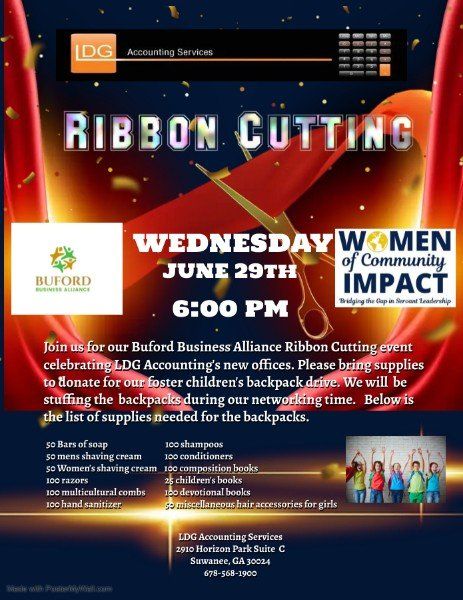

Although extensive, this checklist will help you never miss a financial step and keep you in control of your business’ situation. Does it seem overwhelming? Want quality assistance with tracking your business’ financials? A professional accountant can help with a range of packages and options. LDG Accounting Services would happy to discuss your options. Contact us today!