Types of Business Structures and Tax Implications

1. Sole Proprietorship:

A sole proprietorship is an unincorporated business owned by one individual. The business income and expenses are reported on the owner's personal tax return (Form 1040) using Schedule C. The owner is responsible for paying self-employment taxes on net income and may be subject to estimated tax payments.

2. Partnership:

A partnership is a business owned by two or more individuals who share the profits and losses. The partnership itself does not pay taxes on its income; instead, the partners report their share of the income and expenses on their personal tax returns using Form 1065 and Schedule K-1. The partners are responsible for paying self-employment taxes on their share of the income.

3. Limited Liability Company (LLC):

An LLC is a hybrid business structure that combines the limited liability protection of a corporation with the pass-through taxation of a partnership. The LLC itself does not pay taxes on its income; instead, the members report their share of the income and expenses on their personal tax returns using Form 1065 and Schedule K-1. The members are responsible for paying self-employment taxes on their share of the income.

4. Corporation:

A corporation is a separate legal entity from its owners, and it pays taxes on its income using Form 1120. The owners may also receive dividends, which are taxed at the individual level. This is known as double taxation. However, certain corporations can elect to be taxed as an S corporation, which allows them to avoid double taxation and pass through income and expenses to the shareholders.

Consult With a Tax Professional or Accountant to Determine the Best Business Structure

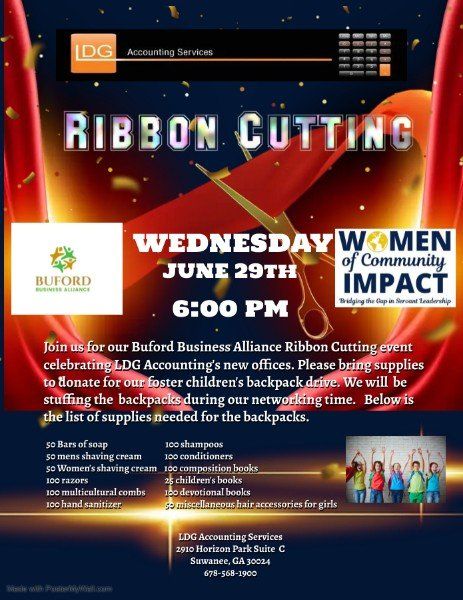

It's important to consult with a tax professional or accountant to determine which business structure is best for your specific situation and to ensure you are meeting all of your tax obligations. The team at LDG Accounting is here to assist you and would happy to discuss your options. Contact us today.